Expense in true estate is turning into a enormous income generating company. Genuine estate organization even though requires great deal of pondering and commercial knowledge for earning a sizeable income. The financial loan element is vital to generating ongoing organization for the investor. Maintaining this objective in consideration, loan providers have made particularly genuine estate investment decision financial loan that tends to make expense in actual estate a good deal much more appealing for even initial timer.

Using a genuine estate investment financial loan indicates you are using the finance for investing in a industrial property. So before you settle for creating genuine estate investment mortgage deal, make certain that you have very carefully chosen the residence from the mortgage availing level of view. Notice that lenders desire a sound revenue making house for considering true estate investment mortgage. Lenders would like to verify that the home is a good profit prospect. This assures in turn the lender of secure and well timed return of the financial loan. However genuine estate investment financial loan is a secured bank loan nonetheless loan provider would like to escape the high priced repossession route and desire as an alternative the secure payback of the bank loan.

Real estate investment financial loan is a secured financial loan. Creditors secure the loan in opposition to the really home the borrower intends to make investment in. offer papers of the home are taken in possession by the loan company for securing the financial loan and are return to the borrower on total shell out off of the loan. This is 1 reason the borrowed amount beneath genuine estate investment decision financial loan relies upon on the variety of property. If the lender values the genuine estate more as attainable cash flow generator or is presently providing good income, increased loan can be pocketed. Generally true estate expense bank loan is presented in the range of £100000 to £3000000.

For the handy pay off actual estate expense mortgage, creditors give you larger period. They can supply you compensation duration of 10 to 30 many years. The investor can wisely unfold the mortgage in greater repayment length for reduction in regular monthly outgo in direction of installments. A good deal of part of the financial loan is hence saved for other utilizations. Real estate expenditure bank loan is a lower curiosity rate mortgage due to the fact it is totally secured and risks for the financial institution are distant.

Because there are negligible pitfalls involved, creditors do not believe two times in considering actual estate expense financial loan for negative credit rating people. In circumstance of payment default, loan company can nevertheless get well the loaned sum by selling the residence of the borrower.

There are some requirements from the lenders of genuine estate expenditure financial loan suppliers. Lenders might question for the house files to make sure the intended investment is for legitimate purpose. Creditors might demand from customers tax records of the property the borrower intends to make investments the bank loan in. so keep this sort of and paperwork all set.

Investors can research for actual estate expense bank loan vendors on net. Number of the bank loan companies have showcased genuine estate investment decision mortgage in their internet sites. Review them for every single aspect and evaluate fascination prices and terms-situations. Right after settling for a suited lender, utilize on-line to him for quicker approval of the mortgage.

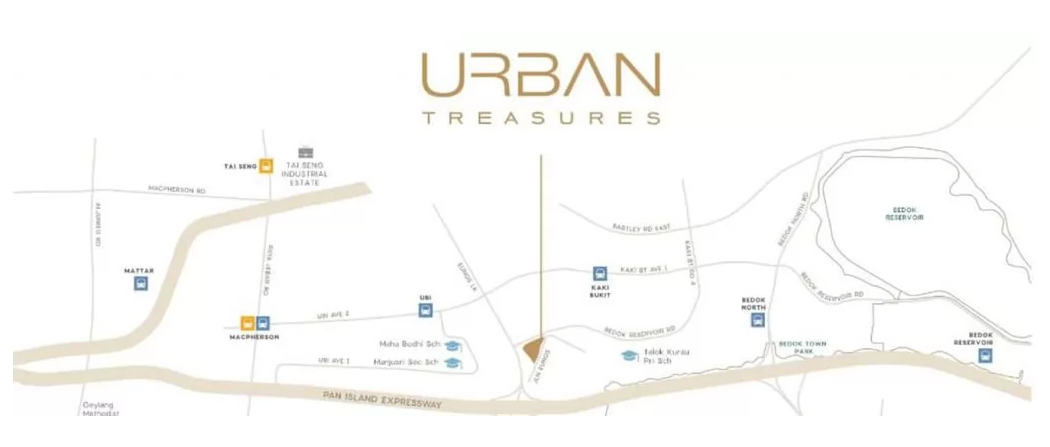

Urban Treasures Showflat in true estate is a hurdle free expertise when the investor opts for real estate investment decision mortgage. Make the loan offer following cautious comparison of different loan deals on provide. Also make sure for well timed reimbursement of the mortgage installment for staying away from debts.